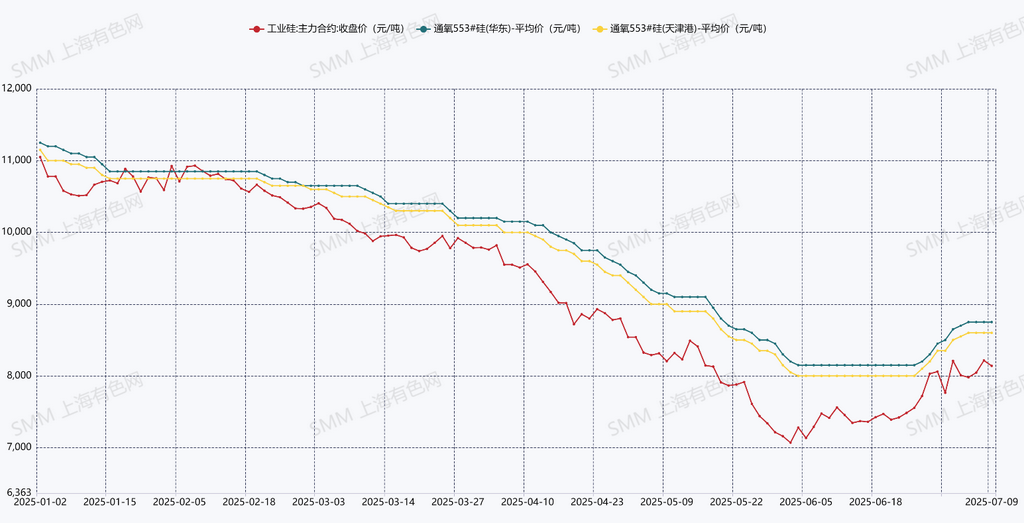

SMM July 9 news: Spot silicon metal and futures prices stopped falling and stabilized before rebounding in June. In the futures market, the main silicon metal contract closed at 8,140 yuan/mt on July 9, up 665 yuan/mt (9%) MoM. In the spot market, oxygen-blown #553 silicon at Tianjin Port was quoted at 8,500-8,700 yuan/mt on July 9, up 600 yuan/mt (7%) MoM. The price increase was mainly driven by improved supply-demand fundamentals and positive market sentiment. On the supply side, large plants in north China unexpectedly implemented production cuts, while some capacity resumed operations in Yunnan during the rainy season in July, resulting in a net production decline. On the demand side, both silicone and polysilicon production schedules showed MoM increases in July, improving silicon metal demand. Policy-driven expectations of polysilicon price hikes also provided support. On the cost side, silicon coal prices stabilized while electrode prices rose due to higher raw material costs. Multiple factors contributed to the spot and futures price increases. However, spot trading volume weakened after the price rally as July-August marks the off-season for silicone and aluminum-silicon alloy consumption.

Supply:SMM data shows June 2025 silicon metal production at 327,700 mt, up 6.5% MoM but down 27.7% YoY. H1 2025 cumulative production reached 1.8728 million mt, down 17.8% YoY. July output is expected to increase further in Sichuan and Yunnan regions, with Yunnan entering the rainy season prompting some silicon enterprises in Baoshan and Dehong to resume operations, likely adding over 10,000 mt MoM. Sichuan's production growth will slow. Most northern enterprises maintained basically stable operating rates, while the restart timeline for large Xinjiang plants remains uncertain, creating supply uncertainties for July.

Demand:Polysilicon production reached 101,000 mt in June (up 5% MoM), with July schedules at around 107,000 mt (continued MoM growth) driven by resumed southwest capacity. Silicone output was 209,000 mt in June (up 13.8% MoM), expected to rise further to 213,000 mt in July. Combined polysilicon and silicone demand for silicon metal is projected to increase by approximately 10,000 mt in July. Primary aluminum-silicon alloy enterprises operated at 50.9% capacity in June (down MoM), while secondary aluminum alloy plants ran at 53.3% (slight MoM increase). July's off-season will see reduced downstream orders, leading to slightly lower operating rates at alloy enterprises.

Bullish factors:Higher polysilicon production schedules, expected polysilicon price increases, rising electrode prices

Bearish factors:Off-season for silicone and aluminum alloy consumption, uncertainty about supply-side production resumptions

SMM view:According to SMM's supply-demand balance data, the industry saw inventory buildup in Q1 2025 and destocking in Q2, resulting in a basically balanced H1 supply-demand situation. In July, due to the uncertainty surrounding the timing of production resumptions following production cuts in the north, if the resumption time is delayed, the balance in July will maintain a destocking pace, with an estimated magnitude of around 20,000 mt. Overall, the positive feedback has been largely realized. Without further positive news to stimulate the market, it will be difficult for the spot silicon metal price to continue its upward trend. Attention should be paid to changes in supply from the supply side.

If you would like to obtain more detailed market information and trends, or have other information needs, please call 021-51666820.

![[Domestic Iron Ore Brief] Iron Ore Concentrates Prices in Shandong Region May Have Some Upside Potential](https://imgqn.smm.cn/usercenter/fljuJ20251217171715.jpg)

![[SMM Coking Coal and Coke Daily Brief] 20260302](https://imgqn.smm.cn/usercenter/GGaSo20251217171716.jpg)